U.S. government shutdown 2025 has begun. Learn who's affected, how markets react, and what could end the stalemate with this practical, live explainer.

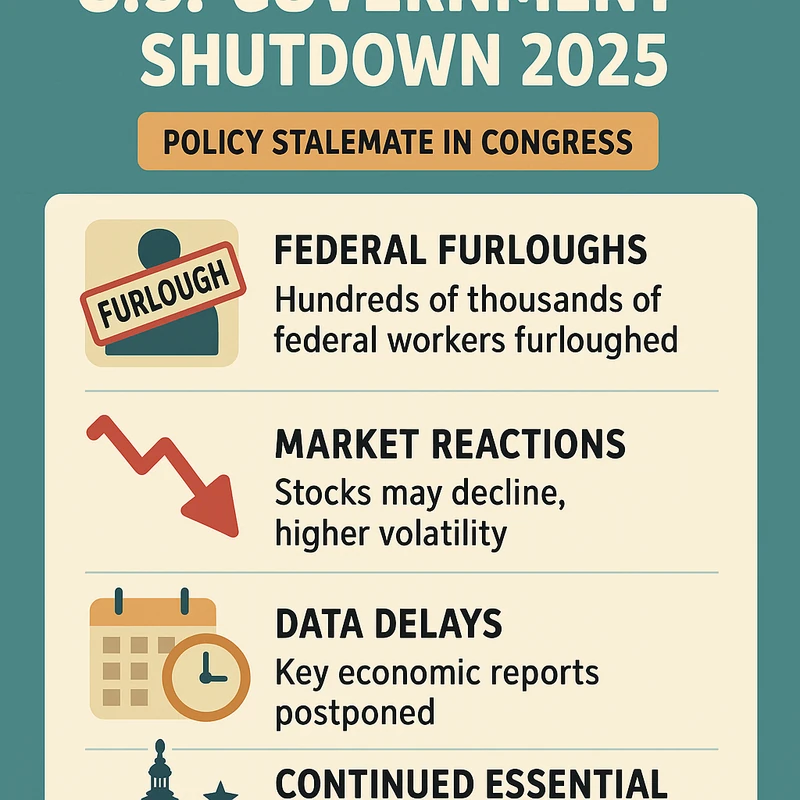

Quick Answer The U.S. government shutdown 2025 began on October 1, 2025, at 12:01 a.m. ET after Congress failed to pass a funding bill. The standoff centers on Democrats’ push to extend ACA premium tax credits and roll back Medicaid cuts, while Republicans favor a clean stopgap. Up to 750,000 federal workers face furloughs daily, and markets moved on uncertainty as agencies halted nonessential work.

Key Takeaway: The U.S. government shutdown 2025 marks a high-stakes budget stalemate with immediate furloughs and global market reverberations, underscoring how fiscal battles translate into daily life and international finance.

Complete Guide to U.S. government shutdown 2025 A live explainer that maps what happened, why it happened, who is affected, and what could come next. Think of it as a rolling panel-by-panel account that blends policy details with real-time market cues.

What happened in the first hours of the U.S. government shutdown 2025?

- The clock struck midnight on October 1, 2025, and many federal offices began furloughs as funding lapses. Essential services continued, but nonessential operations paused, creating a ripple effect across districts and contractors. Analysts flagged immediate disruption to data releases and compliance checks.

- Roughly 750,000 federal workers could be furloughed daily under deepening contingency plans, with some agencies prioritizing public safety and national security. The scale mirrors past shutdowns but is intensified by stricter automatic spending rules.

- The visual impact on daily life was immediate: visitor access limited at national parks, delayed grant processing, and stalled regulatory reviews. Investors watched for how long the stalemate would persist and whether it would trigger broader economic spillovers.

Key Takeaway: The onset of the shutdown 2025 created a rapid, agency-by-agency pause, with a clear line between essential and nonessential duties and a looming risk of data gaps and service backlogs.

What agencies furloughed during the 2025 shutdown, and how deep did the cuts go?

- Education agencies reported furloughs in the tens of thousands, with up to 87% of Education Department staff put on leave as public-facing programs paused. Financial regulators, including the SEC and CFTC, sharply reduced operations, delaying market surveillance and rulemaking.

- The pace of furloughs varied by mission: homeland security and defense-related activities retained many staff, while science and research agencies faced broader nonessential shutdowns. The admin side of government faced backlogs from visas to grant disbursements.

- Private contractors and grantees felt a ripple effect as grant processing slowed, funding announcements stalled, and procurement offices paused new purchases.

Key Takeaway: The 2025 shutdown is uneven by agency, creating a mosaic of paused programs, delayed data, and cascading effects for families relying on federal support and researchers awaiting grants.

What is the budget standoff 2025 about?

- The central clash pits Democrats’ demand to extend ACA premium tax credits and restore Medicaid fills against Republicans’ preference for a clean stopgap with no policy riders. The disagreement centers on federal health subsidies, Medicaid financing, and broader discretionary spending levels.

- House and Senate dynamics drove daily parliamentary theater: party leaders traded messaging, while standing committees awaited budgetary signals that would unlock funding. The broader fiscal question turned on whether temporary funding could be paired with concessions on policy.

- Economists framed this as a test of governance reliability, given the interconnection between federal budgets, social programs, and market confidence. Credit rating watchers noted potential negative implications if the stalemate persists.

Key Takeaway: The budget standoff isn’t just a political spectacle; it’s a policy dispute with real consequences for health programs, social safety nets, and the credibility of U.S. fiscal governance.

What happened to markets during the U.S. government shutdown 2025?

- Global stock futures slipped in the immediate hours after funding lapse news, reflecting uncertainty over regulatory capacity and delayed data releases. Gold and other safe-haven assets rose as investors hedged against volatility.

- Markets faced a patchwork of reactions: some sectors sensitive to government data, like housing and manufacturing, flagged slower reads due to paused data releases. Currency markets showed mixed moves as investors reassessed risk tolerance.

- Analysts warned that the longer the shutdown lasts, the more pronounced the hit to confidence in U.S. governance could become, potentially affecting borrowing costs and capital flows.

Key Takeaway: The shutdown’s market impact is driven by data gaps, policy uncertainty, and investor risk management, with early moves signaling risk-off sentiment that could persist.

What is the likely duration of the U.S. government shutdown 2025?

- Early estimates varied, with insiders suggesting days to weeks rather than months, depending on legislative breakthroughs or concessions. The speed of talks and procedural maneuvering on Capitol Hill will determine the timeline.

- Historical patterns show that shutdown durations are tightly bound to political alignment, debt-limit considerations, and willingness to pass stopgap funding with or without policy concessions.

- Some analysts cautioned that even if a temporary funding patch passes, the policy dispute around ACA credits and Medicaid could reemerge as soon as the next appropriation cycle.

Key Takeaway: Expect a provisional funding phase that could stretch if negotiators reframe the bill, but the ultimate resolution hinges on whether core policy demands are met or sidestepped.

What is the impact on essential services during a government shutdown 2025?

- National security, public safety, and health missions continue, but many nonemergency programs pause. Visa processing and disaster assistance may slow, creating backlogs for individuals and businesses.

- Data releases, regulatory reviews, and grant allocations slowed, increasing uncertainty for researchers, students, and local governments relying on federal support.

- The human toll is felt in public-facing services and programs tied to payroll timing, student aid disbursements, and internal inspections that require continuous funding.

Key Takeaway: Even where essential services continue, a government shutdown creates friction, delays, and backlogs that ripple through families, businesses, and communities.

What could end the shutdown, and what comes after?

- A temporary funding bill (clean stopgap) could reopen agencies, but policy disagreements would persist, requiring a longer-term budget deal or a larger fiscal agreement to address ACA credits and Medicaid funding.

- Political incentives on both sides will shape final resolutions: leadership calculations, public opinion, and economic pressure from markets could push toward a broader negotiation package.

- After a shutdown ends, expect a surge of backlogged work, data releases, and potential emergency funding debates tied to newly negotiated terms.

Key Takeaway: The path out of the shutdown depends on congressional resolve to bridge health policy and budget gaps, followed by a rapid push to clear backlogs and restore regular agency operations.

Which topics are closely tied to this event for further exploration?

- Budget negotiations and appropriations processes

- Contingency planning and federal payroll processing

- Debt ceiling and fiscal policy interplay

- Regulatory oversight and market data integrity

- Health policy, ACA credits, and Medicaid financing

- Economic indicators and market reaction

- Federal data releases and statistical timing

Related topics for internal linking: budget negotiations, payroll processing, continuing resolution, debt ceiling, regulatory oversight, market data gaps, health policy, ACA credits, Medicaid financing, fiscal governance.

Key Takeaway: The shutdown intertwines fiscal, health, and regulatory policy with market dynamics, creating a broad landscape worth tracking for anyone studying government and finance.

Why This Matters The stakes extend beyond headline anxiety: a prolonged shutdown tests the resilience of U.S. budget governance and the reliability of markets that rely on timely data and predictable policy. In the last three months, budget brinkmanship has grown sharper, with new indicators of political risk feeding into investor sentiment and international perceptions of U.S. fiscal stewardship.

Recent developments and trends to watch:

- Market volatility linked to data delays and policy uncertainty, with stock futures adjusting in response to every public sign of a potential deal or stall.

- Credit rating concerns: European and global analysts flagged the ongoing budget stalemate as a negative signal for U.S. credit metrics and governance credibility.

- Agency operations: ongoing furloughs and staffing shifts could extend regulatory backlogs, complicating oversight in finance, health, and consumer protection.

Recent data points you can file away:

- Up to 750,000 federal workers per day may be furloughed, depending on agency-specific contingency plans, affecting payroll timing and services.

- Education Department furloughs include a substantial majority of staff, while regulators like the SEC and CFTC have scaled back operations to preserve core functions.

- Markets reacted with a blend of risk-off sentiment and safe-haven buying, underscoring how governance events translate into portfolio risk assessments.

What this means for you:

- If you’re a student or working with federal data, expect possible delays in data releases and grant funding timelines.

- If you hold investments, be mindful of potential volatility around major budget milestones and debt discussions.

- If you rely on federal programs, monitor agency announcements for changes in eligibility, deadlines, and service access.

Key Takeaway: The U.S. government shutdown 2025 is more than a political struggle; it’s a test of governance, market resilience, and the ability of public institutions to deliver services when funding is uncertain.

People Also Ask What is a government shutdown and how does it work?

- A government shutdown happens when Congress fails to pass funding legislation. Nonessential government functions stop, while essential operations continue. Services range from data releases to visa processing may be paused, and federal workers face furloughs. The immediate consequence is a gap between what the government intends to do and what it can legally fund.

When did the 2025 government shutdown begin?

- It began on October 1, 2025, at 12:01 a.m. ET, after funding lapsed and lawmakers did not approve a continuing resolution or final appropriations. The start date is the moment agencies begin enacting furloughs and contingency plans.

How long can a government shutdown last?

- There is no fixed duration; shutdowns end once Congress passes funding and the president signs it. Historically, durations range from days to weeks or months, depending on political dynamics, debt considerations, and the willingness to accept policy concessions.

How does a government shutdown affect the stock market?

- Markets react to uncertainty, data delays, and potential policy shifts. Stock futures often move in the first hours after news breaks, and volatility can persist as investors reassess risk, liquidity, and corporate earnings timing. Gold and other safe-haven assets may rise in response to risk aversion.

Are federal employees paid during a government shutdown?

- Some federal employees are paid retroactively after funding is restored, but during the shutdown, many workers do not receive pay. Essential workers may continue to work without immediate pay, leading to concerns about personal finances and household budgets.

Why did the 2025 government shutdown happen?

- The root cause is a budget standoff: Democrats seek to extend ACA premium tax credits and roll back Medicaid cuts, while Republicans push for a clean stopgap with fewer policy stipulations. The clash over health policy funding and overall spending levels creates the backdrop for the shutdown.

Key Takeaway: The questions above reflect core search interests around government shutdowns—what they are, when they happen, how long they last, market impacts, and the underlying policy disputes driving 2025’s events.

Next Steps

- Monitor official agency dashboards for furlough counts and contingency plans as the shutdown evolves.

- Track day-to-day market indicators—stock futures, gold prices, and currency movements—to gauge investor sentiment and potential policy breakthroughs.

- Watch congressional leadership briefings and committee hearings for signals about the likelihood of a continuing resolution or longer-term budget deal.

Hypothetical scenarios you might prepare for:

- If a short-term stopgap passes, plan for a flurry of agency backlogs and data releases scheduled in the following weeks.

- If policy concessions accompany funding, be ready for a renewed debate over ACA credits, Medicaid policy, and broader spending limits.

- If markets remain volatile, consider hedging strategies and staying updated with credible analyses from financial institutions and policy think tanks.

Key Takeaway: A proactive approach—tracking a mix of policy signals, agency notices, and market dynamics—helps you stay ahead in a shifting budget landscape.

Related topics you might explore next:

- Fiscal policy and budget reconciliation processes

- Federal payroll systems and emergency funding workflows

- Data reliability and statistical timing during funding gaps

- Health policy, ACA subsidies, and Medicaid financing

- International perspectives on U.S. fiscal governance

Final note from a visual storyteller In my panels, a government shutdown 2025 feels like a cliffhanger: the page is split, the character team is unsure, and every panel shift—every press briefing, every market tick—restructures the scene. If you’re following this as a story, remember that the resolution isn’t just political; it’s about whether the story’s heroes can negotiate a path back to normalcy for real people who rely on every line of policy and every data release.

Key Takeaway: The shutdown 2025 is not just a headline—it’s a living, evolving narrative about governance, markets, and daily life. Stay engaged, ask questions, and watch for the next chapter as legislators seek a workable resolution.